Welcome to #FreshStartMonday!

In the nineties, a French oil company wanted to obtain contracts in Iran to exploit oil and gas fields. To do so, they paid more than US$ 60 million to an Iranian official in exchange for his help in obtaining them. The company earned around US$ 150 million thanks to these contracts.

However, the company did not realize that it was subject to the application of the Foreign Corrupt Practices Act (FCPA) of the United States of America (USA), because it was an issuer that was listed on the Stock Exchange. Upon learning of this situation, the Securities and Exchange Commission (SEC) and the U.S. Department of Justice (DOJ) investigated the company.

In 2013, the DOJ announced that they reached an agreement with the company where they were required to pay a fine of USD$ 250 million. Additionally, the SEC sanctioned them to pay another USD$ 153 million as compensation for the illegal benefits they obtained, plus interest.

The FCPA is a regulation that establishes accounting standards and sanctions corrupt practices abroad committed by companies with ties to the U.S. In the 1970s, corporate corruption scandals abroad led to its approval, which came in 1977. This was crucial to stop the bribery that had tarnished the image and public confidence of U.S. companies and the stock market.

Over time, the FCPA has become increasingly relevant. Joe Biden's administration considers it a crucial tool to protect national security. Corruption is identified as a factor that undermines democracies, fuels authoritarianism, and compromises the stability of their country. Although this is an American law, its reach abroad should not be underestimated. Therefore, it is important to maintain strict anti-corruption practices and to find out if your operations are subject to this regulation.

Who’s Eligible Under FCPA?

The FCPA's anti-bribery provisions apply generally to three categories of individuals and entities:

- Issuers[1] and anyone acting on their behalf. These are companies required to file periodic reports with the SEC because they participate in the U.S. stock or over-the-counter market.

- Domestic natural or juridical persons, and anyone acting on their behalf. U.S. citizens or residents, as well as any organization incorporated in the U.S., are within the scope of the law.

- Certain individuals and entities that violate the provisions of the law while in U.S. territory.

The anti-bribery provisions prohibit persons and entities falling into any of these categories from paying bribes to foreign officials to obtain or retain business.

The FCPA applies to payments, offers, or promises made for the purpose of:

- Influence any act or decision of a foreign official.

- Inducing a foreign official to perform or refrain from performing any act in violation of his or her lawful duty.

- Securing any undue commercial advantage.

- Inducing foreign officials to use their power to influence any act or decision of their government.

In addition, the FCPA's accounting provisions require issuers to develop and maintain accurate books and records, and to design and maintain an adequate system of internal accounting controls. In addition, they prohibit individuals and companies from knowingly falsifying their books and records.

What are the Sanctions?

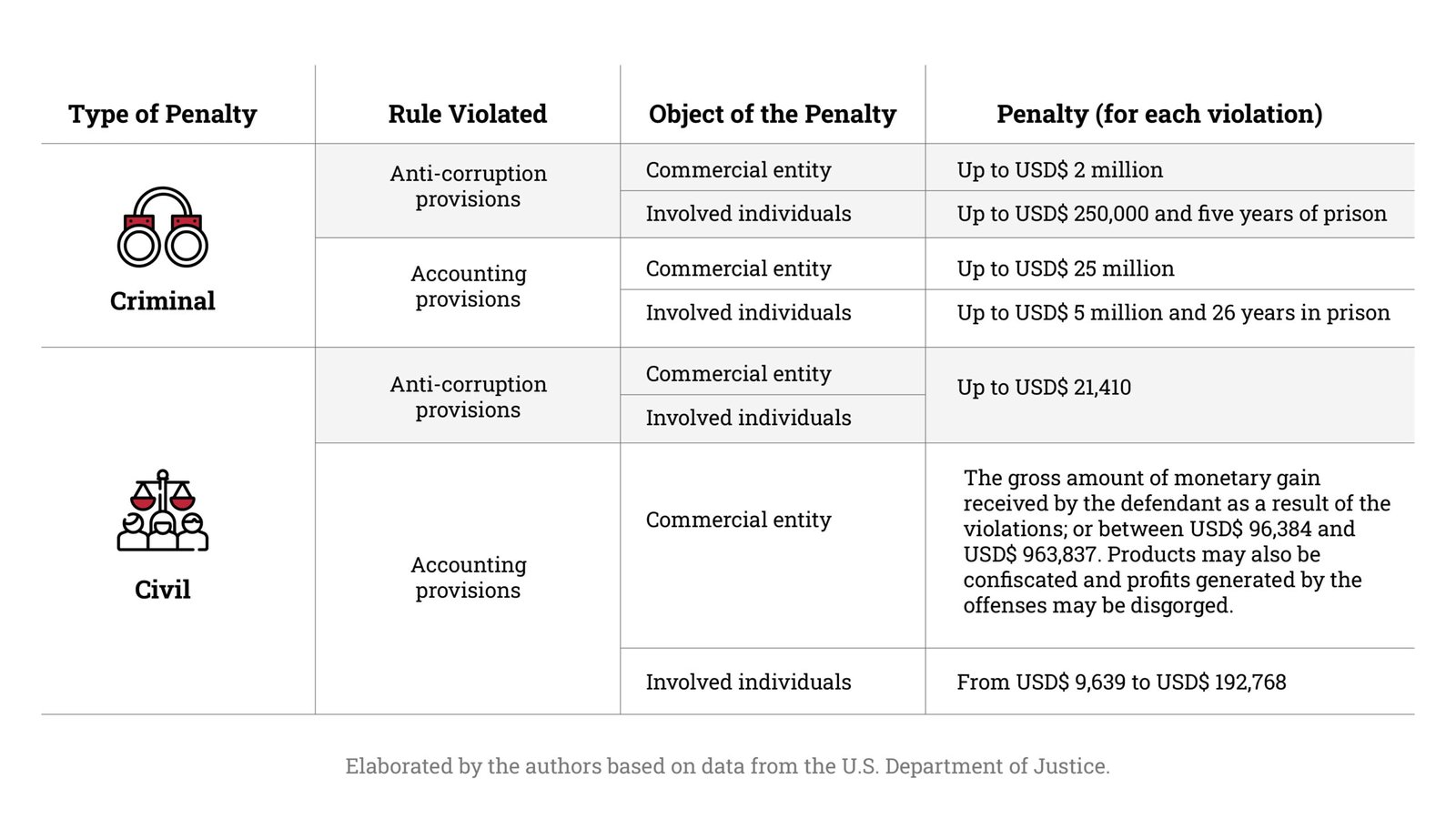

The DOJ and the SEC share the authority to enforce the FCPA. The FCPA establishes different civil and criminal penalties for companies and individuals. The following table summarizes them:

Although the DOJ alone has the authority to bring criminal actions, both the DOJ and the SEC have civil authority to enforce the FCPA. The DOJ can bring civil actions against citizens, domestic legal entities, and foreign nationals for violations when they are in the U.S. The SEC, on the other hand, can bring civil actions against issuers.

The purpose of these measures is to return the perpetrator to the same position he was in before committing the crime, ensuring that he does not benefit from his misconduct.

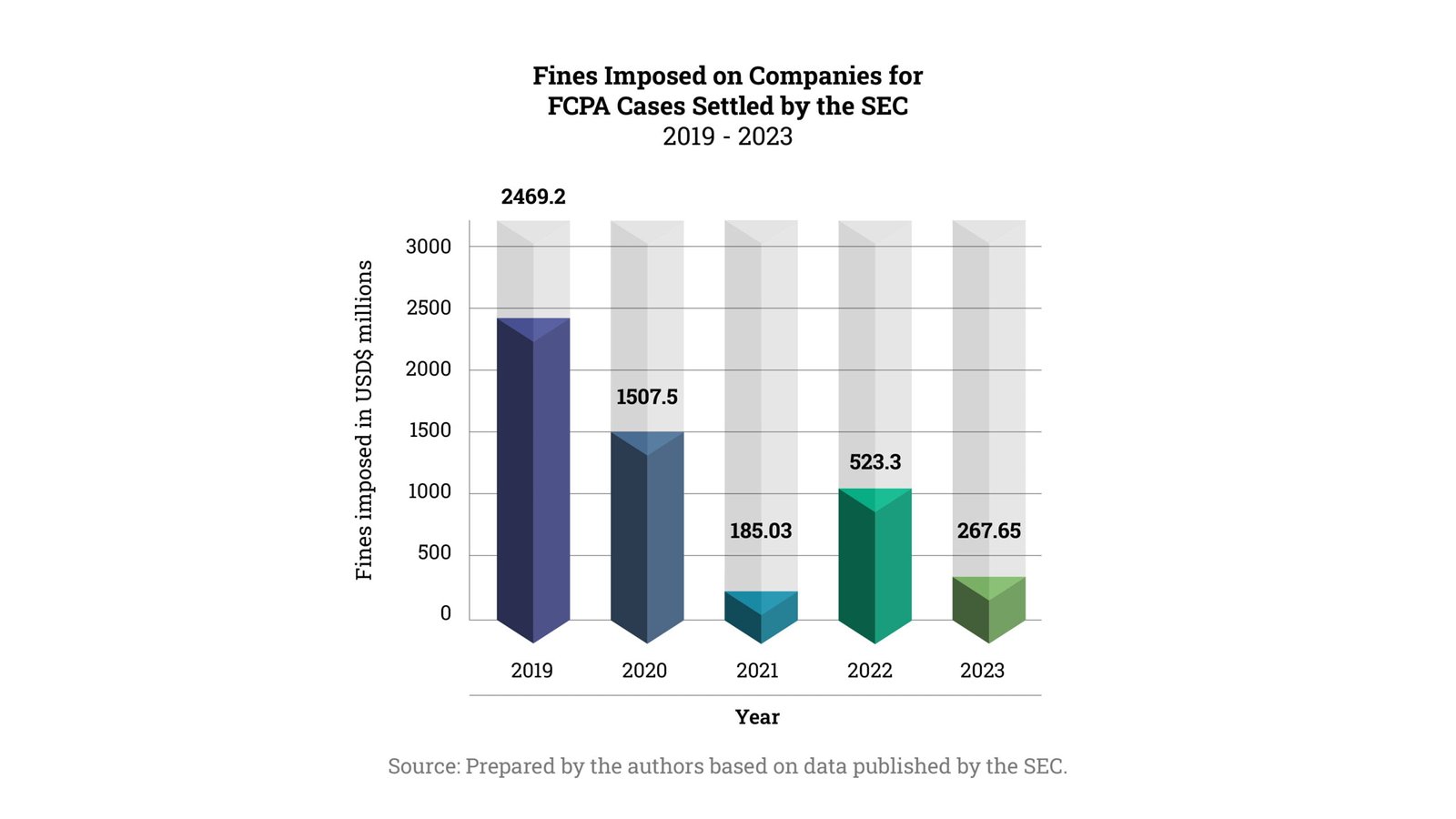

The following chart shows the total fines imposed on different companies during the last five years according to the SEC's official website. It does not include sanctions applied to individuals:

The graph shows that penalties vary by the number and magnitude of infractions, as well as adjusting for illicit profits.

How do I file a complaint?

If you are an individual, a U.S. company or an affiliate of a U.S. company operating in Guatemala, and you have been the victim of an irregular requirement, you can file a complaint with the DOJ or the SEC.

If you wish to evaluate a situation in relation to FCPA and possible risks derived from its application, do not hesitate to contact us to direct you to a team of professionals specialized in it.

[1] Issuer: any company listed on a stock exchange or participating in the U.S. over-the-counter market.