Do you enjoy getting your yearly musical roundup with Spotify wrapped? Have you watched the hit-show Baby Reindeer on Netflix yet? Have you stayed in an Airbnb in Guatemala in the last three years? If you answered yes to one or more of these questions, the Guatemalan Tax Authorities (SAT) are interested in auditing and collecting taxes on these and similar activities.

In April, the SAT superintendent Marco Livio Díaz stated that they are taking the necessary steps to make Netflix, Spotify, Meta (Facebook and Instagram) and other streaming or online sales apps pay the Value Added Tax (IVA). In the case of Airbnb, they are also looking to collect Income Tax (ISR) that renters have not declared since 2021.

The tax authorities have increased their audits, as well as the tax burden, to increase annual revenue. But what tools does the SAT have at its disposal to achieve its objectives?

Digitalization of the SAT

According to the SAT's Institutional Strategic Plan 2021-2025, one of its main objectives is to make it easier for taxpayers to comply with their tax obligations. During Marco Livio Díaz tenure, which started in 2020, the SAT has focused on digitizing and facilitating tax processes.

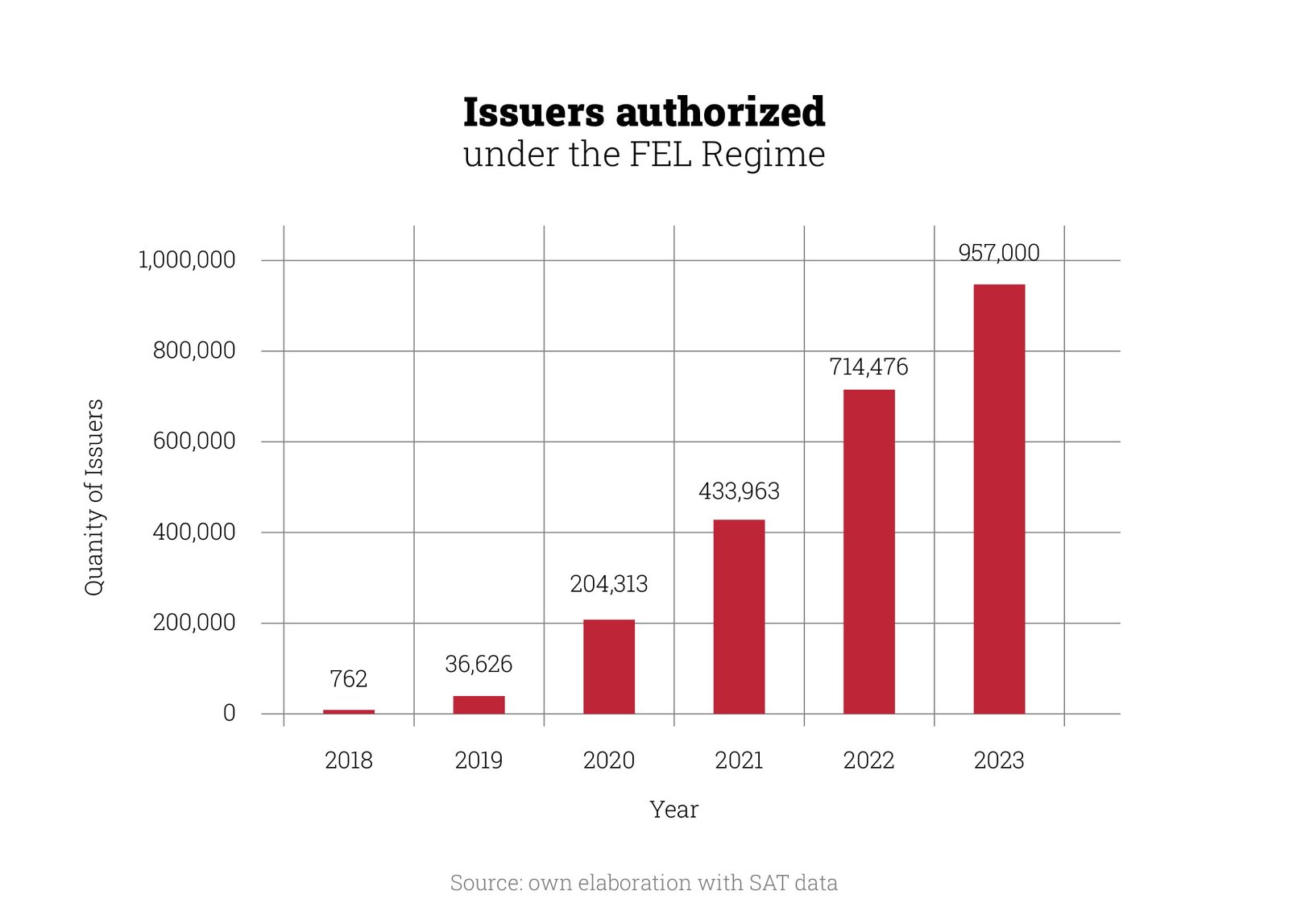

One of the tools that has enabled this digitalization is the Online Electronic Invoice (FEL). Graph 1 shows the number of users authorized to issue electronic invoices. In 2020, there were 204,313 issuers. Three years later, there are almost one million, an increase of more than 752,687 taxpayers.

A second tool is the Virtual Agency, which facilitates tax and customs services, the issuance of the FEL, among others. More than 28 million transactions were carried out on this platform in 2023.

The SAT has also developed applications for inventory and income tax reporting, electronic vehicle transfers and tools for filling out forms, to name a few.

This digitalization process has been fruitful for the government. Net tax collection in 2023 grew by 7.9% compared to that achieved during 2022. On average, the collection increased by 10% per year between 2018 and 2022.

According to the SAT's analysis this is not only due to economic growth, but also to the fact that its new programs strengthen its auditing efforts and increase the number of taxpayers who pay regularly.

New Auditing Strategies

Just as the SAT has sought to facilitate the payment of taxes, another objective of its Strategic Plan is to increase tax collection and reduce the tax non-compliance gap.

2023 closed with a 12% tax burden of the Gross Domestic Product (GDP). This was an increase of 0.3% from 2021. The new government intends to increase this number to 13% without raising taxes, which points to more taxation in the coming years.

One of the strategies being used by the SAT is the new Electronic Audits Program (Fisel), to obtain real-time information from taxpayers and analyze their data. They were able to carry out 92,488 audits during 2023. Of these, 92% were done during times of increased commerce, such as Easter and the holidays.

Thanks to the Fisel system, during the massive audit campaign of December 2023, the SAT obtained adjustments for Q611.5 million (US$78.7 million). This result estuvo un 53% por encima de su meta.

The second strategy was used to scrutinize digital platforms such as Airbnb. Thanks to Decree 9-2017, the SAT has at its disposal the Convention on Mutual Administrative Assistance in Tax Matters signed with the European Union and member countries of the Organization for Economic Cooperation and Development (OECD).

The Convention allows SAT to request information from the tax authorities of other countries and receive assistance in the collection of taxes. Countries may even use precautionary measures to assist in the collection of taxes from other signatory members. This cooperation includes, but is not limited to:

- Income or profit taxes.

- Taxes on capital gains.

- Taxes on net worth.

- General consumption taxes, such as value added tax or sales tax.

In the Airbnb case, the SAT used this mechanism to contact the Irish tax authorities and request data. This is how SAT determined that 7,242 properties were rented in Guatemala, some 254,000 times, between 2021 and 2022. With this data, they can collect the amounts that they consider were not reported.

If your organization operates in different countries, this convention could also impact you with their respective tax authorities as they may request information from the Guatemalan SAT to try to collect the taxes mentioned above.

Digitalization is, therefore, a tool that has facilitated tax processes for taxpayers. However, it also helps the SAT to do their auditing, so it is important to be prepared in case of receiving an information request.

If you have any questions, please do not hesitate to contact us.