The 2023 election year was full of surprises for Guatemala. The country experienced an unprecedented political crisis that marked the environment with uncertainty. However, the Guatemalan economy proved to be robust enough to weather these events without major shocks. Today, the country's main macroeconomic indicators still point to long-term stability.

Macroeconomic trends describe the complex outlook in the wake of the Covid-19 pandemic and the political events of the past year. However, in 2024 President Bernardo Arévalo’s new government presents new opportunities. His government plan contemplates infrastructure and environmental sustainability projects that could attract investment in construction, logistics, and renewable energy, among others.

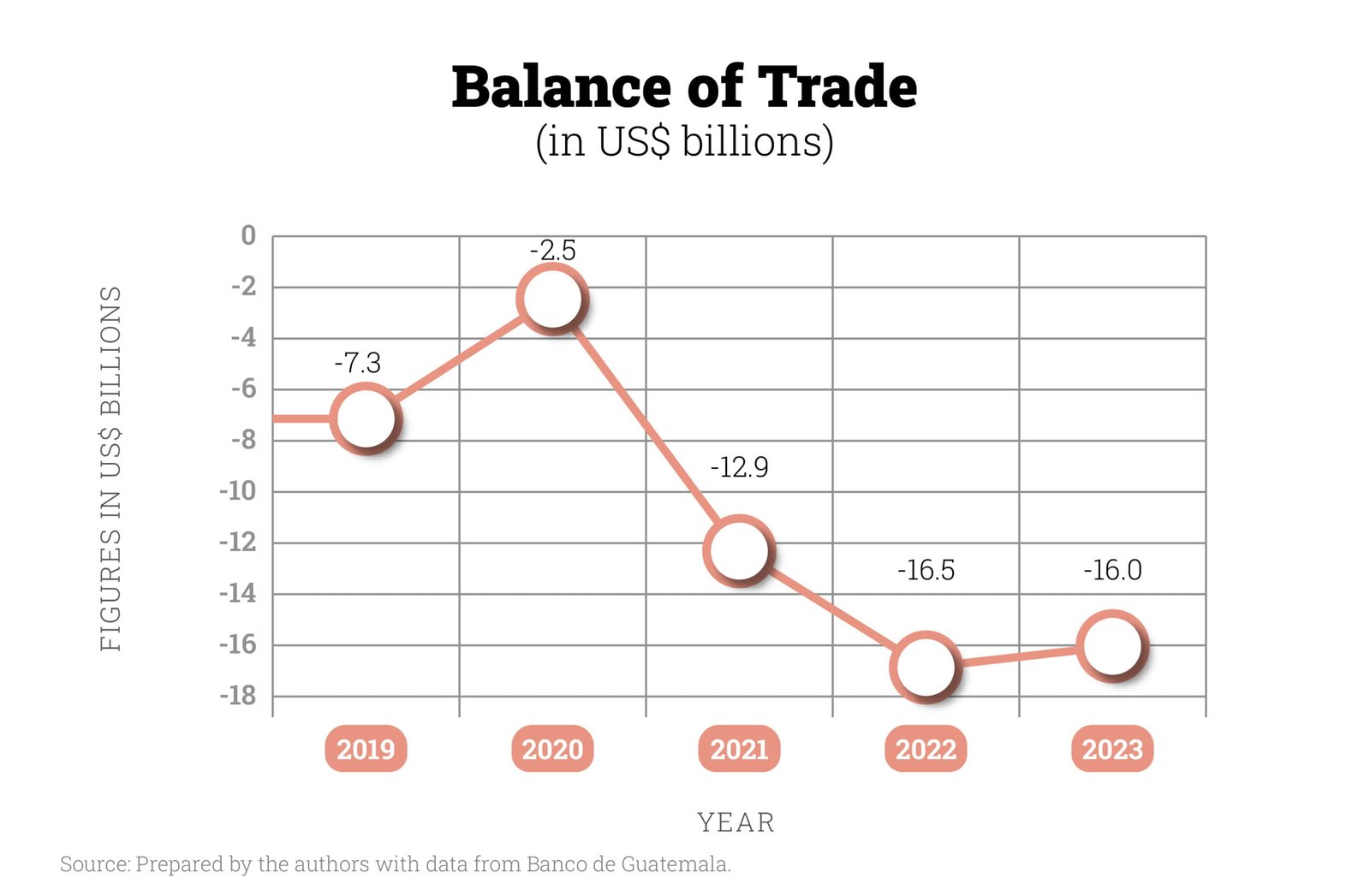

Balance of Trade (BOT)

In Guatemala, imports exceed exports, resulting in a negative BOT. This gap narrowed significantly during the pandemic, but it was temporary. The country's economic reopening showed a sharp increase in imports, with a negative balance of US$12.8 billion in 2021. Since then, it has remained above -US$16 billion.

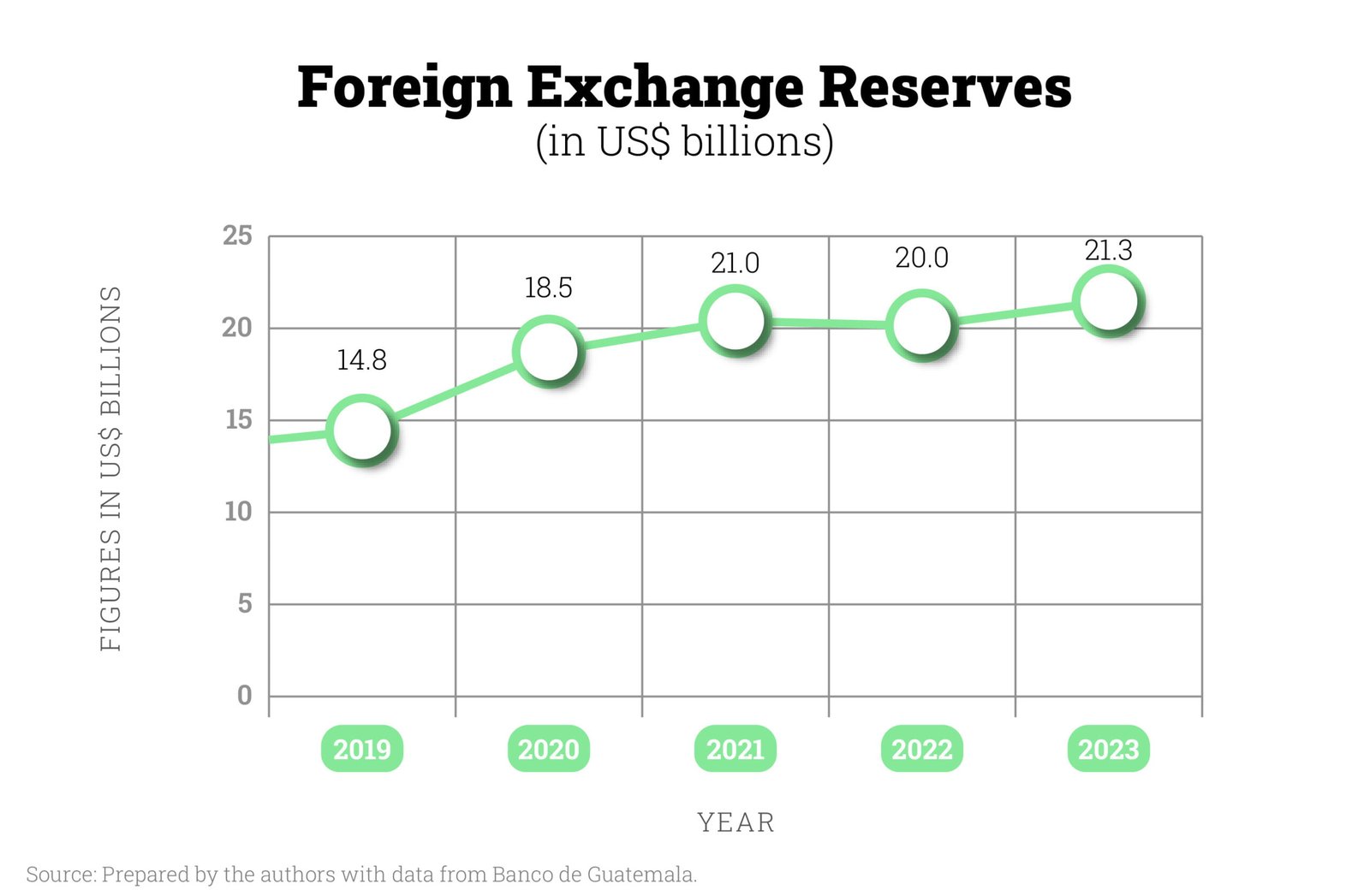

Monetary Reserves

Despite having a negative balance of trade, Guatemala has increased its foreign exchange reserves. The central bank (Banguat) reported reserves of US$14.8 billion in 2019. These have increased, reaching US$21.3 billion in 2023, an increase of 44% over 2019. This is mainly due to foreign currency inflows through family remittances. In 2023 alone, Guatemala received US$19.8 billion in remittances.

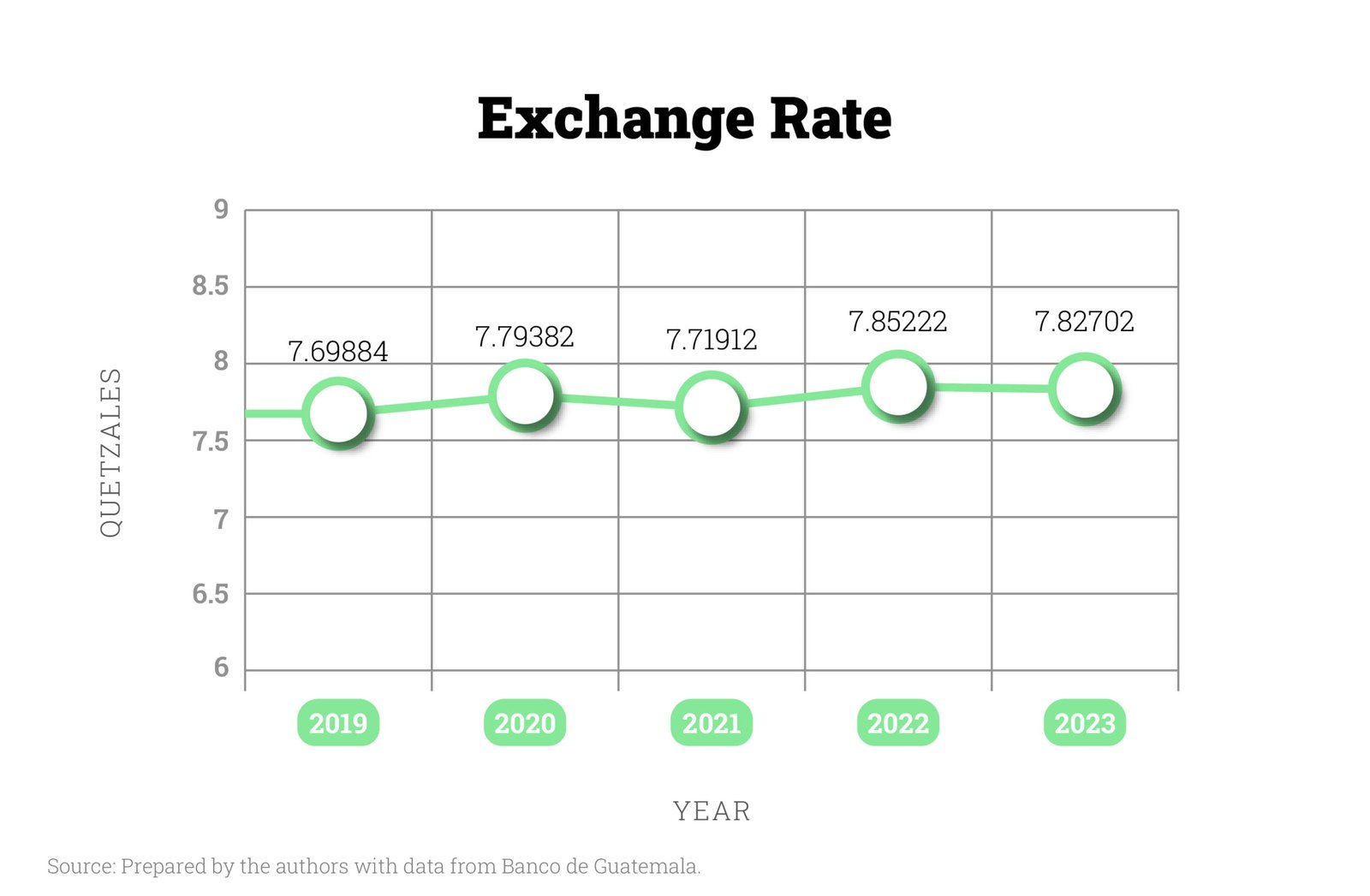

Exchange Rate

The Quetzal is known for being a stable currency over time, fluctuation has not exceeded 15 cents in the last five years. In 2022 there was generalized inflation in the world and Guatemala was no exception. However, this did not affect the value of its currency due to the monetary policy that the country has maintained.

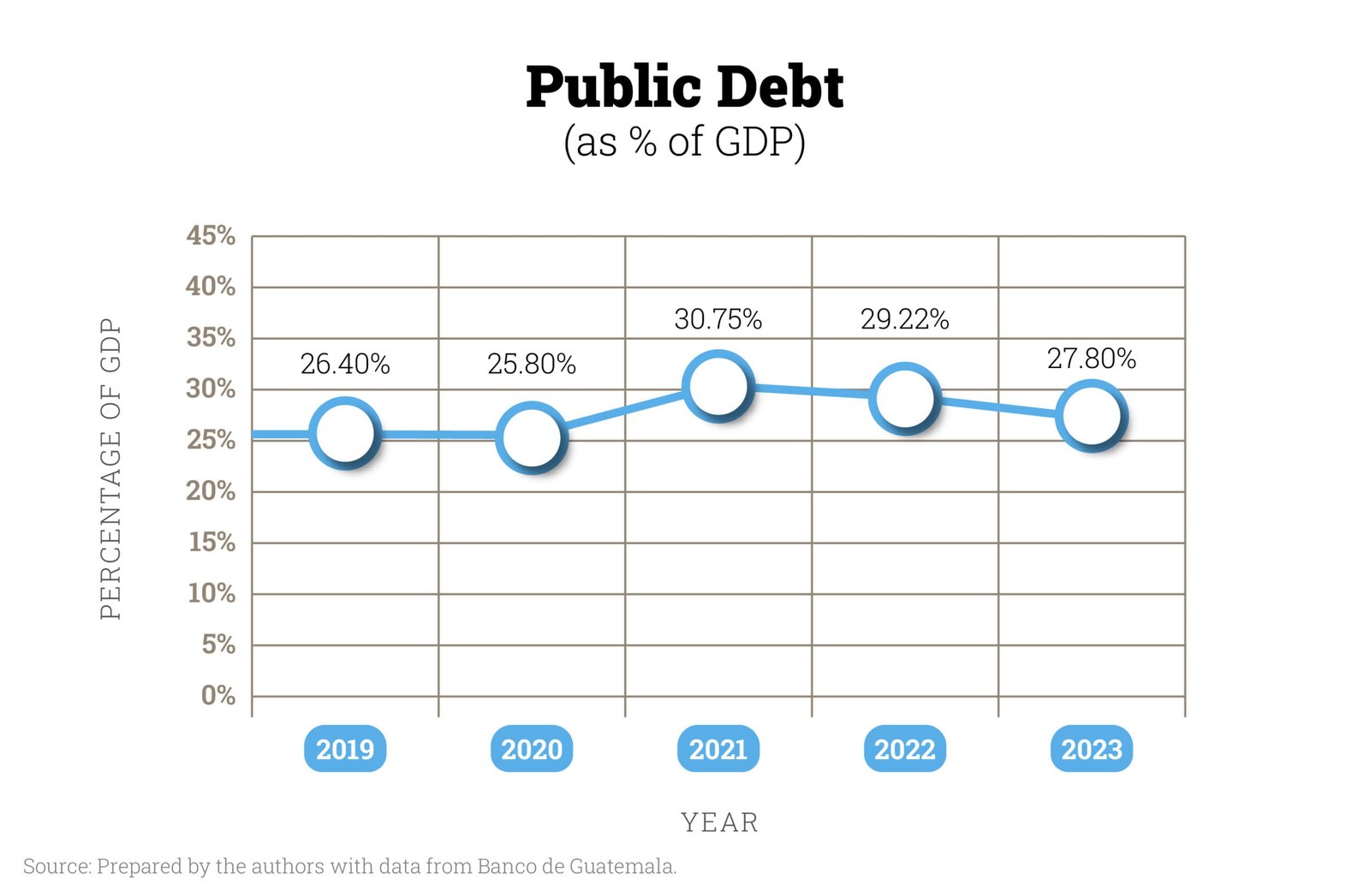

Public Debt

External public debt, as a percentage of the Gross Domestic Product (GDP), has risen and fallen in recent years. This number is below the global trend. According to the International Monetary Fund (IMF), world public debt stood at 92% of global GDP in 2022, more than triple the level of Guatemala in that same year.

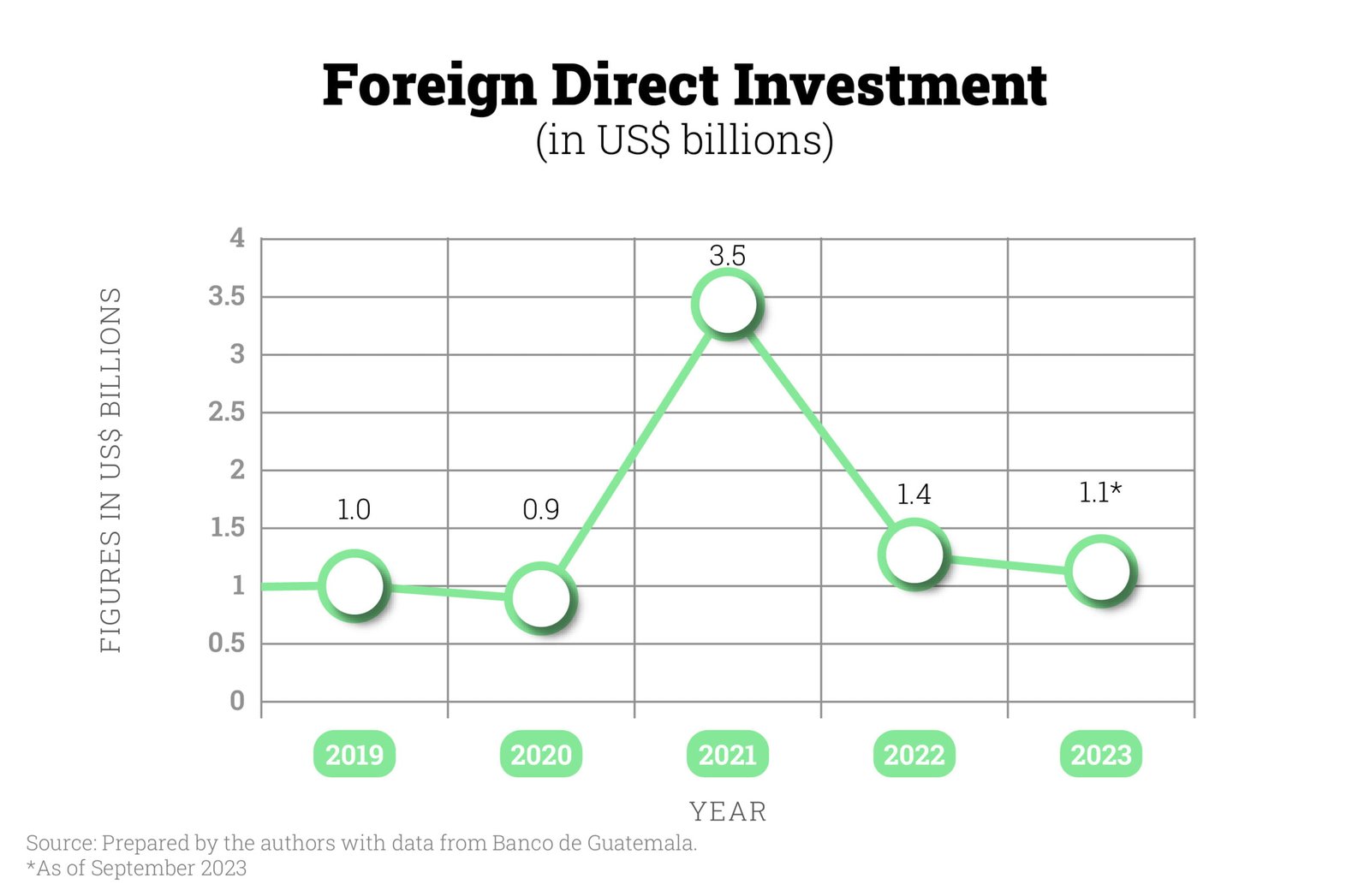

Foreign Direct Investment (FDI)

FDI decreased in 2020 with respect to the previous year by 4.4%, with a total amount of US$0.9 billion. This decrease was not as pronounced compared to the rebound observed in 2021: an increase of 73% amounting to US$3.5 billion. This increase was mainly due to the acquisition of Comcel (Tigo), a telecommunications company, by the multinational Millicom Internacional Cellular S.A. The operation was sold for US$ 2.2 billion.

However, as of 2022, FDI returned to levels similar to the previous trend. The latest data is only up to September 2023 with US$1.1 billion.

It remains to be seen whether investment reached the same amount as in 2022, as the political crisis may have negatively impacted FDI in 2023. While FDI was not significantly affected by the pandemic, it is possible that it will react to the political instability and uncertainty experienced in the second half of last year.

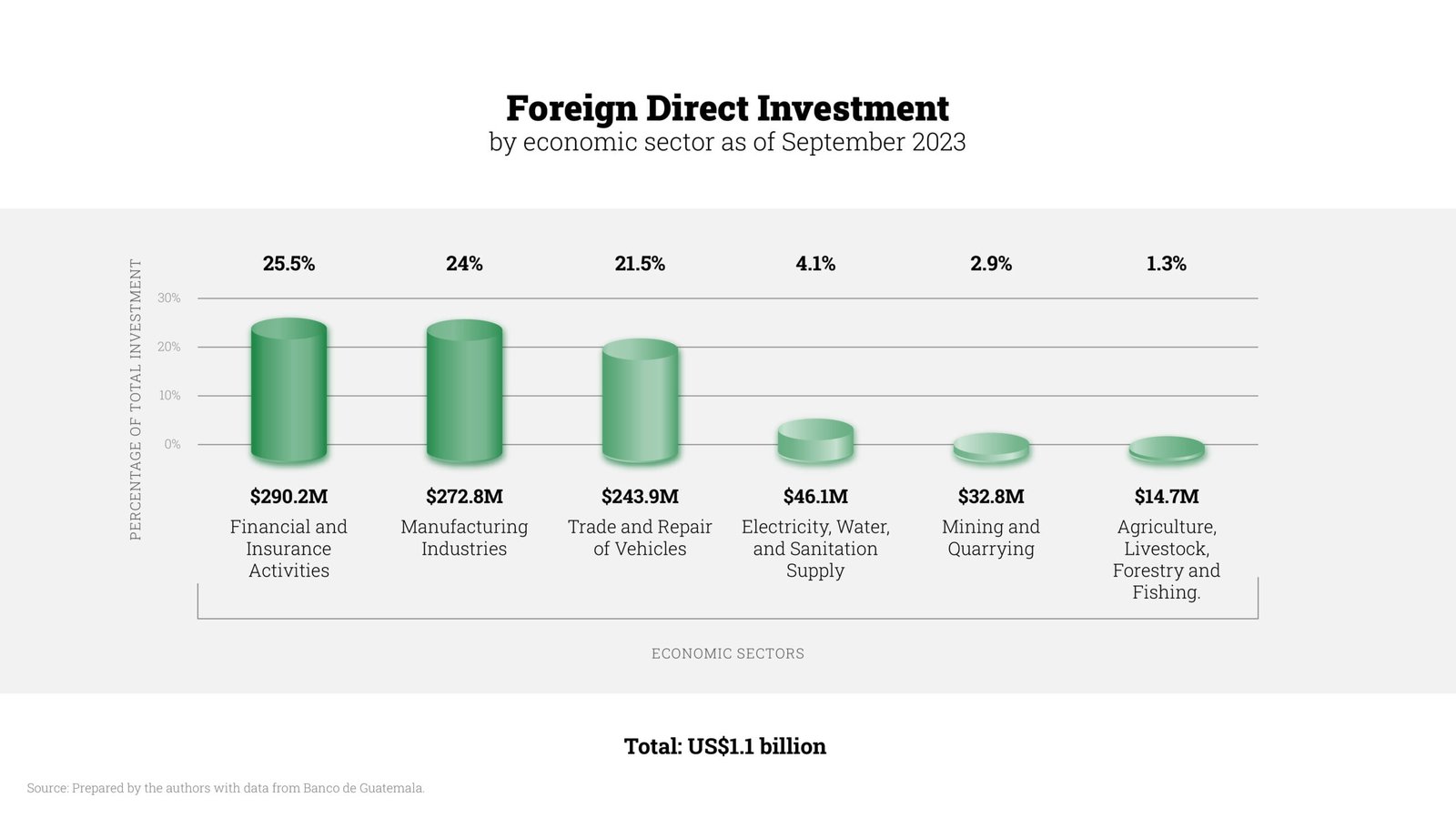

FDI by Economic Sector

Three economic sectors received 71% of the FDI: financial and insurance activities; manufacturing industries; and trade and repair of vehicles. In 2023 alone, new vehicle sales increased by 18%.

Agriculture, livestock, forestry and fishing, an important economic sector, received only 1.3% of the investment.

Tax Burden as a Percentage of GDP

This measure helps to compare tax burdens between countries. It illustrates what percentage of GDP the governments levy to collect taxes. The graph compares Guatemala with other countries in Central America and the rest of the continent. From this selection, Brazil has the highest tax burden, taxing 43.28% of GDP. On the other hand, Guatemala is the country with the lowest tax burden with 12.66%. The other Central American countries, except for Costa Rica, double this value. El Salvador, for example, has a tax burden of 25.77% of GDP.

Inflation

In 2022, the global economy experienced a generalized inflationary phenomenon. That year Guatemala recorded a rate of 9.24%. However, inflation was successfully controlled in 2023, with a rate of 4.18%. This figure is similar to previous years, showing the stability for which Guatemala is known.

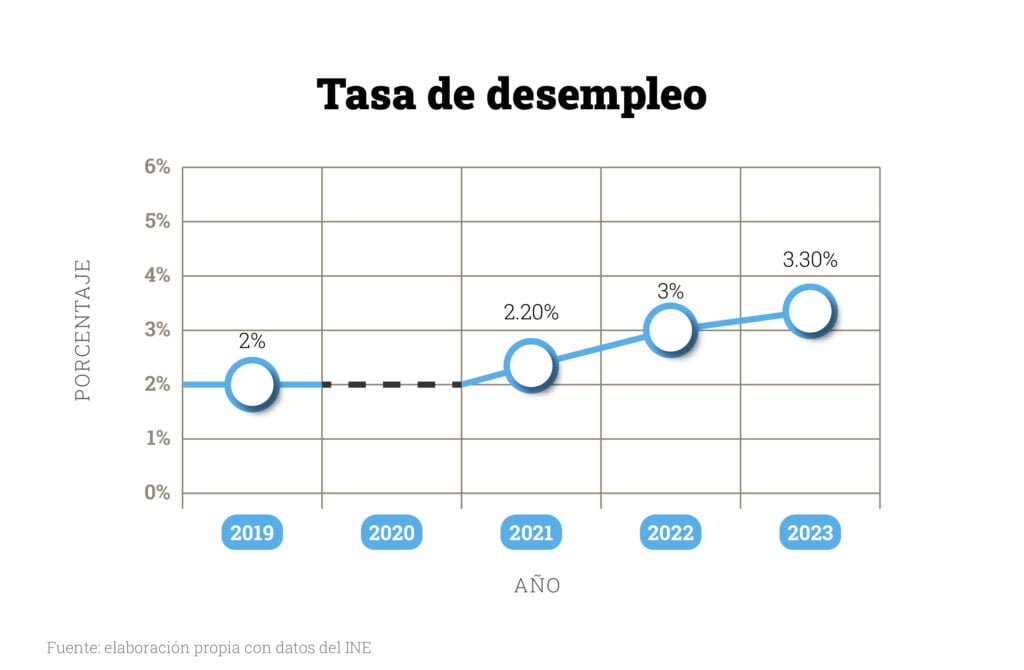

Unemployment Rate

The unemployment rate has been on the rise in recent years. In 2019, the National Institute of Statistics (INE) reported unemployment at 2%. However, this indicator has gradually increased to 3.3% in 2023. There is no data for 2020 because Covid-19 health measures prevented INE from conducting surveys.

Conclusions

Macroeconomic indicators suggest that the Guatemalan economy has remained stable over the last five years, despite the pandemic and the extraordinary events the country has experienced.

The most robust indicators are monetary policy, with a Quetzal that has maintained its value against the U.S. dollar over the years, a growing foreign exchange reserve, and an external public debt below the global average.

Except for 2022, inflation has been kept under control. Additionally, the low tax burden, compared to other countries in the region, provides the Guatemalan economy with greater competitiveness and long-term certainty.

FDI has continued to increase steadily. Data for 2023 indicate that the main economic sectors that attracted investment were financial and insurance activities; manufacturing industries; and trade and repair of vehicles. However, this trend could be altered by the public policies and direction taken by the new government, especially in the areas of infrastructure and logistics, public transportation, and energy.

Finally, the increase in FDI over the years has not been reflected in the unemployment rate, which has also increased. This means that the investment destination is not generating enough jobs to fill the available labor force.