Newsletter #132 / January 2022

On February 8, 2022 the Congress of the Republic of Guatemala approved the Insolvency Law, Decree 8-2022 (the Law). The purpose of the Law is to “regulate insolvency, its content covers the Reorganization Plan, the Registry of Insolvency Proceedings and Administrators, the Insolvency Administrators, the insolvency process, the liquidation, the incidents and appeals.”. It is still pending its sanction by the Executive Branch and later publication in the Official Gazette.

The Law will be applicable to all individuals and legal entities and it excludes the obligations of the State, autonomous, semi-autonomous and decentralized entities and Municipalities. Also, it excludes banks, finance, insurance and reinsurance companies and other entities subject to the supervision of the Superintendence of Banks. Excluded entities may act as creditors.

Some of its main provisions are summarized below:

BASIC PRINCIPLES

The following principles must be observed in the application and interpretation of the Law:

- Principle of priority of claims: claims are ordered hierarchically, creditors of each class of claims shall receive equal treatment.

- Principle of good faith: good faith is manifested in the timely compliance with the accounting obligations of the person, in the transparency of the same, and the non-existence of speculative business or concluded in fraud of creditors.

- Principle of publicity: the existence of the Reorganization Plan and the beginning of the liquidation shall be duly publicized at the beginning of the insolvency proceedings in order to inform any interested party and the public in general.

- Principle of celerity: the insolvency must be resolved efficiently and quickly, avoiding the depreciation or loss of the assets.

- Principle of continuity: in the event of a state of insolvency, the use of the Reorganization Plan will be promoted as a suitable means to achieve the recovery of the claims. The Judge and the Insolvency Administrator will ensure the preservation and operation of the company, the wealth and the jobs it generates.

- Principle of oral proceedings: the insolvency courts will accept and promote the use of oral proceedings during the hearings held within an insolvency proceed.

REORGANIZATION PLAN

The purpose of the Reorganization Plan is the partial or total recovery of recognized claims and the continuity of the debtor's economic activity. The Plan may consider a financial, administrative or operational reorganization and may be agreed on present and future assets and rights.

The Plan may be private or under a court-ordered reorganization plan. A private plan does not require judicial authorization, while a court-ordered plan does. The Plan must contain the following matters:

- Description of the debtor's economic activity and the ordinary course of its operations.

- The proposed reorganization solution, including the financial, operational or administrative actions to be taken and a budget execution plan.

- The description of the required financing, detailing the necessary resources, source of origin and specific destination.

- The proposal for payment to creditors.

PRIORITY OF PAYMENTS

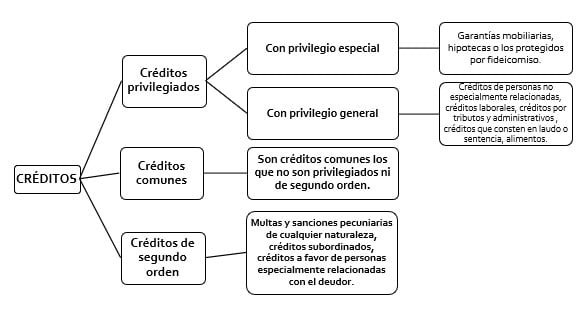

The Law introduces a new classification of the priority of payments:

INSOLVENCY ESTATE

The insolvency estate is made up of the estate assets and the estate liabilities:

- Estate Assets: shall include all assets and rights that are part of the debtor’s estate as of the date of the declaration of the insolvency proceeding, including future cash flows from ongoing businesses or income of any kind from the payment of accounts receivable and the assets an rights that the debtor acquires until de termination of the insolvency proceeding.

- Estate liabilities: shall include all the claims and obligations demanded by the creditors during the insolvency proceedings.

INSOLVENCY PROCEEDING

The competence to hear insolvency proceedings is held by the Courts of First Instance of the Civil Branch in the place where the debtor has its domicile or its registered office.

The situations in which the insolvency of the debtor may be presumed, and the insolvency proceeding may be requested are:

- When the estate liabilities exceed the estate assets.

- When there are two or more liens due to execution demands or executions against the same debtor.

- When there are two or more obligations of the debtor in which the document has been protested or payment has been required in writing and they are more than 4 months overdue.

- When there is a closing of more than 20 business days of the administrative headquarters or of the establishment where the debtor carries out its main activity, with the exception of causes of force majeure or that derive from the ordinary course of business or type of economic activity.

- When the debtor is unable to comply with its obligations or considers that it is close to defaulting on its obligations to its creditors.

- When the debtor, in the case of a legal entity, the members of the administrative body or legal representatives hide or are absent from the debtor's registered office or main place of business for more than 60 business days without leaving legal representatives with sufficient powers and means to comply with their obligations.

The Insolvency Law was approved based on the Favorable Opinion with Amendments to Bill proposal number 5446 issued by the Commission of Economy and Foreign Trade in December 2021. Among the most important amendments to the original Bill 5446 that the Favorable Opinion left out is the “Cross-Border Insolvency”, which sought to solve the insolvency of debtors operating in different countries, a global trend that has been recognized by UNCITRAL, and included in its Model LawGuatemala missed a valuable opportunity to join the global trend in cross-border insolvency, considering that today's commercial phenomenon is global and not only national. With the approval of the Insolvency Law, the Collective Execution regulated in the Code of Civil and Commercial Procedure would be derogated.

We hope that the new regulations will bring along the institutional efforts and resources concerning the professionalization of law enforcement officials, and that this will become another tool for economic development in our country.

For more information, please contact:

Rodrigo Callejas rodrigo.callejas@carrillolaw.com

Emanuel Callejas emanuel.callejas@carrillolaw.com